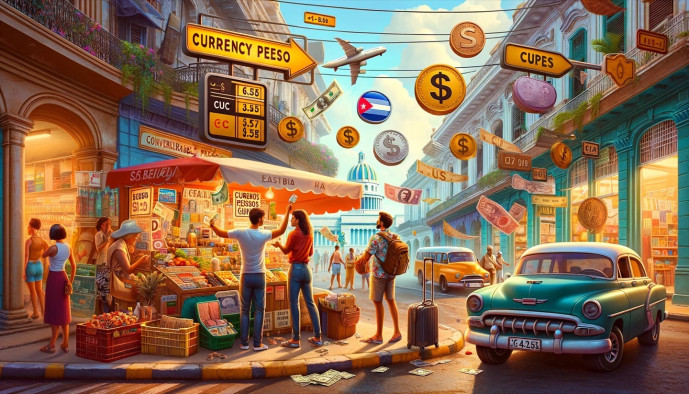

Currency in Cuba

Navigate Cuba's currency: Exchange rates and essential expenses

Cuba’s financial landscape is intricate, with the Cuban Peso (CUP) as its official currency while foreign currencies, notably the US Dollar (USD) and the Euro (EUR), are also prevalent.

Essential tips

- Cash is Essential: Relying solely on ATMs in Cuba is not advisable. So bring cash for all your trip, preferably in Euros (EUR), as they have lower exchange fees. While US Dollars (USD), British Pounds (GBP), and Canadian Dollars (CAD) are also accepted. Note that USD transactions incur higher exchange fees.

- Currency Exchange: Exchange only small amounts of money into Cuban Pesos (CUP) at a time.

- Bank and Credit Cards: Before departure, contact your bank or financial service provider to confirm that your debit/credit cards will function in Cuba. However, be cautious and do not assume guaranteed functionality, as financial rules can change rapidly.

- Diversify Your Financial Resources: A combination of cash and cards is the safest strategy. Even if assured by your financial provider, having a backup for accessing cash is crucial. Do not depend on a single source of money.

- Budget More Than Expected: Cuba can be unexpectedly expensive, with prices for food, drinks, and accommodation having significantly increased in recent years. Carry more cash than you anticipate needing to avoid being caught short.

- Foreign Currency Payments: Most private establishments, such as restaurants, bars, and guesthouses, prefer payments in foreign currencies.

- Exchange Surplus CUP: Ensure you exchange any remaining Cuban Pesos back to your preferred currency at the airport before leaving Cuba.

Understanding the Currency: The Cuban Peso

The only official currency of Cuba is the Cuban Peso (CUP). It’s been this way since the 1st of January, 2021 when the government abolished the Convertible Peso (CUC), thereby doing away with the dual currency system that was previously in place.

The most critical thing to remember is that the Cuban Peso (CUP) is not available outside Cuba and can only be purchased in the country. It’s impossible to exchange it outside of Cuba.

Given the nature of Cuba’s financial infrastructure, it’s crucial to note that cash is king in Cuba. Whether you’re dealing in local CUP or foreign currencies like USD, EURO, or GBP, cash is your safest bet.

What currency should you bring to Cuba?

As of April 10th, 2023, the Cuban government changed the laws regarding the USD. The result? The USD is now equal to the EURO in terms of its exchange rate in Cuba. So whether you bring USD or EURO with you, don’t worry – they’ll both work. GBP also works but is less easy to exchange.

Currencies widely accepted in Cuba: Euro, US Dollar, British Pound, Swiss Franc, Japanese Yen.

One thing to keep in mind, though, is to ensure your notes are either new or at least in very good condition. Worn notes won’t be accepted.

What is a CADECA ?

CADECA, the official exchange houses, are available in cities throughout Cuba, offering currency exchange services :

- Currency Exchange: Foreign Currencies to CUP.

- Credit Card Cash Advances (Visa and MasterCard). Withdrawals are feasible across Cuba with various currencies, excluding those from U.S. banks. Cirrus and Maestro cards are universally incompatible with Cuban ATMs. (This information is not personally verified)

Exchanging Money

Money exchange in CADECA’s

The Cuban Peso (CUP), also referred to as moneda nacional (MN) is officially exchanged at approximately 120 CUP to 1 USD.

You can convert foreign currencies to CUP at the official government rate at airports, banks, hotels, CADECA exchange bureaus, and shopping centers.

When converting USD to CUP via official entities, an 8% fee is imposed, effectively adjusting the rate to 110 CUP per USD.

All other currencies incur a 2% exchange fee.

Changing in the Street

Alternatively, these currencies are often traded on the black market at significantly higher rates – 265 CUP to 1 USD – in the street., although this practice is illegal.

For current informal exchange rates, refer to El Toque, but be aware that actual transactions may vary from these indicative figures.

Advices

- Upon arrival in Cuba, avoid exchanging all your money immediately at the airport or your host without proper information. Locals can discern newcomers and might exploit this by proposing unfavorable exchange rates. I highly recommend waiting to consult with your guide or accommodation host upon arrival, as they can direct you to the most reliable exchange locations.

- Exchange rates can vary depending on where you are traveling in Cuba, better rates being offered in Havana, so be sure to plan accordingly!

- When changing money on the street, ensure you are not deceived by rapid counting. Find a tranquil spot and methodically tally the banknotes to confirm the full amount is present. Keep a calculator at the ready.

Withdrawing Money

In Theory most credit cards, apart from those issued by US banks, will work in Cuba. However, only VISA and Mastercard cards are accepted. It’s always a good idea to double-check with your bank to ensure your card will function in Cuba.

In many cases, Debit cards do not work in Cuba. I personally tested with N26 and Revolut and none of them worked.

Important: Electronic transactions, including credit card payments and ATM withdrawals, continue to operate on a 25 CUP to 1 USD rate. We recommend to use the unofficial street exchange rate instead.

What is MLC ?

Another recent addition to the Cuban monetary system is the MLC card (Moneda Libremente Convertible), which is Cuba’s bitcoin equivalent to the current value of the USD. The MLC card can be obtained at the CADECA at Jose Marti Airport and used in businesses such as cigar and rum shops, some optional activities, and even some evening shows.

You can Purchase MLC prepaid cards at CADECA outlets in denominations ranging from 50 to 1,000 MLC.

Please take note that as for 2023, It is not possible to purchase MLC in USD, the remaining balance of your card can not be refounded and the card expiration is set to 2 years.

In Cuban supermarket you can buy only with MLC, they don’t accept cash or international credit / debit cards ! So if you need imported goods, plan accordingly.

So do you need an MLC card? You won’t need one if your credit card works in Cuba or if you bring enough cash.

Conclusion

Remember, the economic situation in Cuba is fragile, and payment methods and exchange rates can change frequently. So, always keep a close eye on the most recent information before your trip. Happy travels!